Improving forecasting accuracy using quantile regression neural network combined with unrestricted mixed data sampling

Keywords:

Neural network, Quantile regression, Unrestricted mixed data sampling frequency, Frequency alignments, GDPAbstract

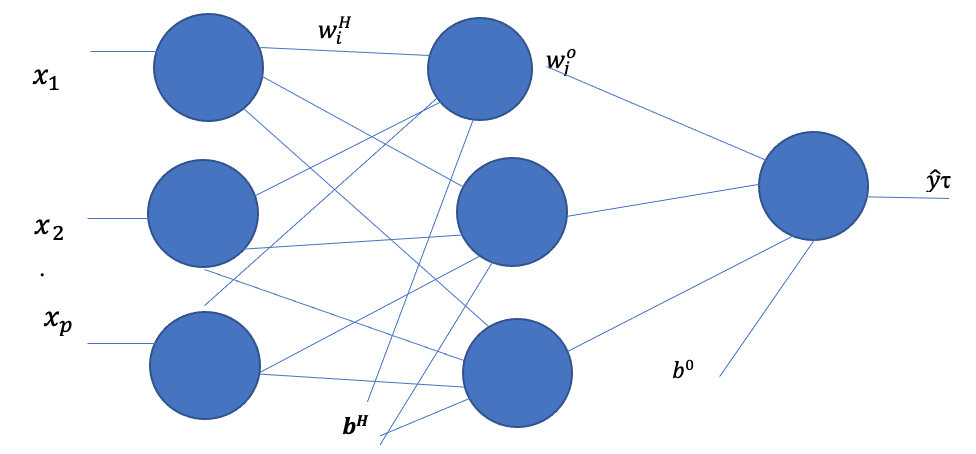

A traditional regression method involving time series variables is often observed at the same frequencies. In a situation where the frequencies differ, the higher ones are averaged or aggregated to the lower frequency. A Mixed Data Sampling (MIDAS) regression model was introduced to address such problems. In any country, stakeholders are interested in monitoring and forecasting accurately the Gross Domestic Product (GDP) using the dynamics of macroeconomic variables. We applied the hybrid QRNN-U-MIDAS model to forecast quarterly GDP using monthly and weekly data. The Quantile Regression Neural Network (QRNN) is designed to model nonlinear relationships amongst data sampled at the same frequency. Therefore, we take advantage of QRNN skills using the optimization techniques of gradient descent-based algorithms to optimise the estimated loss function Ea (\tau), and introduce them into the U-MIDAS framework, which can handle mixed data frequencies, and construct a QRNN-U-MIDAS model. The suggested hybrid QRNN-U-MIDAS model was implemented in an R-package that we created to perform both simulation and real-time data applications. The findings indicate that the QRNN-U-MIDAS regression model outperforms competing models in terms of its capacity for prediction across the conditional distribution of a response variable with a comprehensive view of the information contained in the variables, which is lacking in other competing models like U-MIDAS, ANN-U-MIDAS etc. More so, this novel model will add to the existing works of literature on robust forecasting models.

Published

How to Cite

Issue

Section

Copyright (c) 2023 Umaru Hassan, Mohd Tahir Ismail

This work is licensed under a Creative Commons Attribution 4.0 International License.